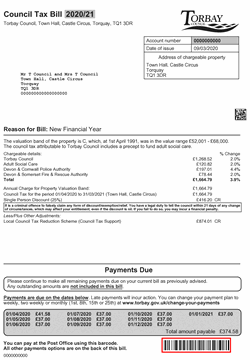

The council tax bill has a lot of information on it. Below there is a broken down bill which explains the different parts of the bill:

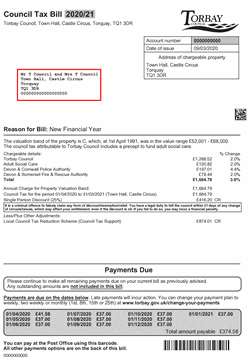

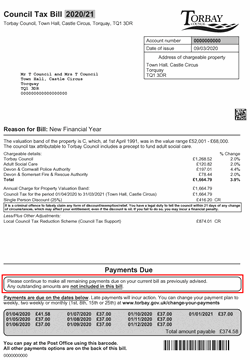

Council tax account number and address of chargeable property

This is your council tax account reference number, the date the bill was issued and address of the property that the bill is for.

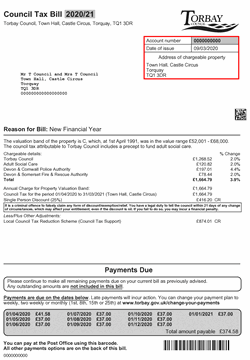

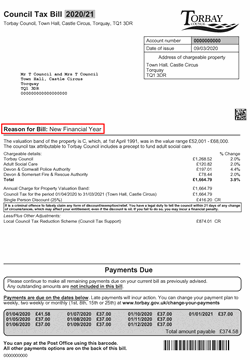

Reason for bill

This tells you why you have been sent a bill.

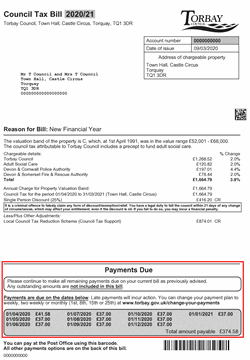

Balance due for payment

The amount you need to pay. If there is a 'CR' this means your account is in credit and you may be due a refund.

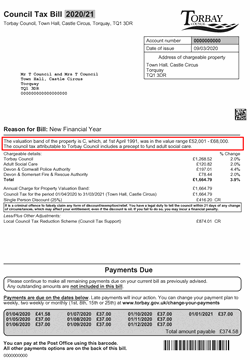

Band and value range

This shows the property band and the value range of band.

Chargeable details

This is how the total council tax charge is worked out.

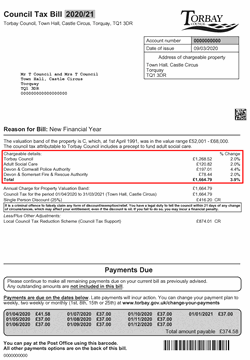

Chargeable details

This is how your council tax charge is worked out:

The 'Annual Charge for Property Valuation Band' is the full charge for this property from 1 April to 31 March

The 'Council Tax for the period' is the full charge for the dates shown

It includes the period(s) you have been charged for, any reductions you may have, court costs, penalties and payments made.

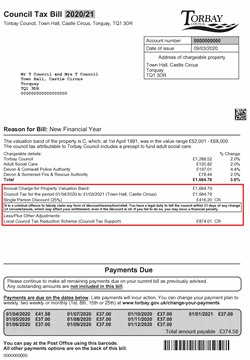

The barcode

You will need this to pay your bill at the Post Office or a shop displaying the Payzone sign.