Initially we set out the key findings of chapter 3. Note that referencing and data sources are provided in the body of the chapter.

Key findings

- The Torbay Housing Market Area (HMA) is substantively contained within the local authority area.

- 3% of household spaces have no usual residents.

- Just under 32% of households in Torbay have 2 or more bedrooms than they technically need.

Within the owner-occupied sector this rises to just under 43% of households.

- Torbay has a significantly higher proportion of converted flats than comparative geographies. ▪ Torbay has a significantly higher proportion of bungalows than comparative geographies.

- Torbay has a higher proportion of households in the private rental sector and a significantly lower proportion of households in the social rented sector than comparative geographies.

- 5% of Torbay’s housing stock was built pre-1900 while only 13.7% of the housing stock is post-1993 (to 2019) which is higher and lower respectively than comparative geographies.

- Torbay has approximately one tenth of the mandatory licensable HMOs in comparison to both Exeter and Plymouth.

- EPC (Energy Performance Certificate) records indicate that over 70% of Torbay’s stock is SAP rated D or lower.

- Social housing outperforms both the private rented sector and the owner-occupied sector in respect of energy performance.

The Housing Market and sub-Market Areas

As a starting point for setting the housing baseline for Torbay, we consider the functional housing markets of Torbay as determined through previous assessments. The established definition of a functional housing market area is “the geographical area in which a substantial majority of the employed population both live and work and where those moving house without changing employment choose to stay”. (Identifying sub-regional housing market areas (CLG, March 2007); paragraph 1.6.)

The South West Regional Housing Board identified two Housing Market Areas (HMAs) within the Exeter and Torbay housing sub-region. These were the Exeter HMA, which covered the local authority areas of East Devon, Exeter, Mid Devon and Teignbridge, and the Torbay HMA which covered the administrative area of Torbay Council. In effect the Torbay HMA was assessed as being contained within the local authority boundary.

The SHMA 2007 sought to identify functional sub-markets operating within or including the HMA. To do this Opinion Research Services (ORS) analysed individual Census Output Areas (COAs). COAs with strong migration links or strong links in terms of travel to work patterns were merged to form combined areas. This process has been repeated and sub-markets were effectively defined in respect of their commonalities as referred to above. Without delving too deeply into the process, the outcome of this work was that 9 sub-market areas were identified within the two HMA areas of Exeter and Torbay. The Exeter HMA was divided into 8 housing sub-market areas. In contrast the Torbay housing sub-market area was found to contain the local authority area and extending outwards into a small part of Teignbridge to the north-west of its boundary and into a small part of South Hams to the west and south.

The NPPF and the current PPG on the HENA are silent on Housing Market Areas and sub-market areas. The formation of housing market partnerships and the identification of functional HMAs and sub-market areas was key to the development of SHMAs. The mantra of the time was that housing markets do not follow local authority boundaries. Which is clearly true, however planning policies are set at local authority level. Hence it can be speculated that the HMA is only relevant in plan-making terms if the plan-making authorities are able and willing to set consistent policies across the HMA area.

The Torbay Economic Strategy 2017-2022 (Evidence Base) sets out the inflow and outflow of labour in Torbay. This is based upon Census 2011 data which was published after the SHMA update 2011. The table below includes labour flow into and out of local authorities of over 100 workers. The greatest labour flow is to and from Teignbridge, but in net terms the highest outflow is from Torbay to Exeter. Along with East Devon (featured below), Teignbridge and Exeter form part of the Exeter HMA. The local authority with which Torbay has the next highest number of labour flows is South Hams. Along with Plymouth (also featured below), South Hams forms part of the Plymouth and South Devon HMA. These figures support the SHMA assessment of the extent of the Torbay sub-regional HMA.

| Local authority | Labour outflow | Labour inflow | Net impact |

|---|---|---|---|

| Teignbridge | 5,192 | 4,736 | -456 |

| South Hams | 2,668 | 1,896 | -772 |

| Exeter | 2,127 | 385 | -1,742 |

| Plymouth | 784 | 675 | -109 |

| East Devon | 415 | 161 | -254 |

| Total | 12,977 | 8,591 | -4,386 |

Source: Torbay Council (Census 2011 derived)

The next sections set out the details of housing in Torbay, including type, tenure and the profile of occupants. It updates the SHMA by utilising Census 2011 as the base source of data as opposed to the Census 2001. It makes comparisons with the neighbouring ‘urban’/ ‘urban hub’ areas of Exeter and Plymouth, and the national picture (England). For the purposes of this assessment, we refer to the Torbay HMA as an urban hub area due to the fact that the majority of the population live within three connected urban centres, although it should be noted that there is also a significant rural hinterland, part of which falls within a designated Area of Outstanding Natural Beauty.

Household spaces and occupancy rates

Initially, we consider occupancy rates of the housing stock at the time of Census 2011. This indicates the proportion and number of the available household spaces that are ‘usually’ occupied at the time of the Census. Table 3.2 below shows that there are 59,010 household spaces with a usual resident. There are 5,360 household spaces with no usual residents which, at 8.3% of total household spaces, is significantly greater than comparative geographies.

Within any functional housing market there will be some unoccupied property on the simple basis that at any point in time there will be properties empty pending sale or properties empty pending probate, as examples. There are referred to as transactional vacancies.

Where the proportion of unoccupied properties is as high as 8% this demonstrates some form of irregularity in the market. This may indicate a relatively high percentage of second homes, a relatively high number of long-term empty properties, or both. We refer to empty homes specifically later in this chapter.

| Type | Torbay number | Torbay % | Exeter % | Plymouth % | England % |

|---|---|---|---|---|---|

| All: Dwelling type | 63,966 | 100 | 100 | 100 | 100 |

| All: Household spaces | 64,370 | 100 | 100 | 100 | 100 |

| Household spaces with at least 1 resident | 59,010 | 91.7 | 96.5 | 96.3 | 95.7 |

| Household spaces with no usual residents | 5,360 | 8.3 | 3.5 | 3.7 | 4.3 |

Source: Census 2011

Occupancy rating

Table 3.3 below considers occupancy rating in respect of the numbers of bedrooms per household. Under-occupation occurs where a household is defined as having one or more bedroom more than their defined need. Occupancy rating gives us an opportunity to look at the efficiency of the current housing stock. The majority may choose to under-occupy own home. However, if under-occupation is caused by a lack of suitable downsizing options, then it is a strategic consideration for the authority.

The table below shows that 42.6% of owner-occupied properties have 2 or more bedrooms in excess of their defined need, while within the social rented and private rented tenures this is 9.2% and 9.0% respectively. Overcrowding is more common within the social rented stock, with 6.8% of social rented properties having an undersupply of bedrooms.

| Bedrooms (+/-) | All stock no. | All stock % | Owned % | Social rented % | Private rented or rent free % |

|---|---|---|---|---|---|

| +2 or more | 18,738 | 31.8 | 42.6 | 9.2 | 9 |

| 1 | 22,137 | 37.5 | 40.8 | 25.3 | 32.4 |

| 0 | 16,616 | 28.2 | 15.3 | 58.7 | 54 |

| -1 or less | 1,519 | 2.6 | 1.3 | 6.8 | 4.7 |

Source: Census 2011

The table below compares occupancy rates with the neighbouring urban boroughs. These figures seem relatively consistent aside from the fact there is less overcrowding in Torbay compared to the surrounding areas.

| Bedrooms (+/-) | Torbay % | Exeter % | Plymouth % |

|---|---|---|---|

| +2 or more | 31.8 | 32.2 | 30 |

| +1 | 37.5 | 33.8 | 34.9 |

| 0 | 28.2 | 30.6 | 31.2 |

| -1 or less | 2.6 | 3.3 | 3.9 |

Source: Census 2011

Characteristics of the housing stock

House type

Table 3.5 below sets out the number and relative proportions of household spaces by house type. A household space may not refer to a whole dwelling as some dwellings are shared by more than one household. Table 3.2 above sets out both the number of dwellings and the number of household spaces. Within Torbay there are just under 400 more household spaces than dwellings.

The table below compares Torbay with the neighbouring urban areas and England as a whole. Torbay has a higher proportion of detached properties and a lower proportion of terraced houses than its neighbours. Worthy of note, Torbay has a higher proportion of converted flats and flats in commercial premises than neighbouring urban areas.

| Type | Torbay no. | Torbay % | Exeter % | Plymouth % | England % |

|---|---|---|---|---|---|

| Whole house/ bungalow- detached | 14,088 | 21.9 | 13.6 | 10.8 | 22.3 |

| Whole house/ bungalow- semi detached | 15,012 | 23.3 | 25.6 | 29.3 | 30.7 |

| Whole house/ bungalow- terraced | 15,143 | 23.5 | 32.7 | 33.5 | 24.5 |

| Flat/apartment- purpose built | 11,409 | 17.5 | 20.3 | 17 | 16.7 |

| Flat/apartment- conversion | 7,208 | 11.2 | 5.9 | 8.4 | 4.3 |

| Flat/apartment- in commercial premises | 1,292 | 2 | 1.1 | 0.3 | 1.1 |

| Caravan or other temporary structure | 218 | 0.3 | 0.7 | 0.3 | 0.4 |

| Total | 64,370 | 99.7 | 99.9 | 99.6 | 100 |

Source: Census 2011

Table 3.6 utilises data from council tax bandings as published by the Valuation Office Agency

(VOA). The data is more up to date than the Census, although the data does not distinguish between occupied and unoccupied property, or where a single property is occupied by more than one household. As such, the Census is used as the base data for examining the functional housing market.

That said, VOA does report a different categorisation of housing type. This provides us with additional information through which we can qualify the Census data set out in Table 3.5. The table below breaks down the housing stock by house and bungalow, unlike the Census. From this, we can see that the housing stock in Torbay consists of a significant number of bungalows which make up 16.1% of the whole housing stock. This is a higher proportion than the comparative geographies. Comparing the profiles in Tables 3.5 and 3.6, it is reasonable to assume that bungalows make up approximately half the detached household spaces identified in Table 3.5.

| Type | Torbay no. | Torbay % | Exeter % | Plymouth % | England % |

|---|---|---|---|---|---|

| House: detached | 7,010 | 10.4 | 9.9 | 6.6 | 15.6 |

| House: semidetached | 10,190 | 15.1 | 19 | 23 | 23.7 |

| House: terraced | 16,970 | 25.1 | 33.5 | 34.8 | 26.3 |

| Flat/Maisonette | 21,630 | 32 | 30.7 | 27.6 | 23.2 |

| Bungalow | 10,880 | 16.1 | 5.2 | 7.2 | 9.3 |

| Total | 67,500 | 98.7 | 98.3 | 99.2 | 98.1 |

Source: Valuation Office Agency 2019

Size of housing

Table 3.7 below sets out the size of household spaces by number of bedrooms both numerically and as a proportion of the available stock. Note that the denominator is occupied household spaces as opposed to all household spaces.

The proportions are relatively consistent across the 3 areas. It is noteworthy that the proportion of larger properties (4 or more bedrooms) in Torbay is consistent with the neighbouring urban areas and yet Torbay has a significantly higher proportion of detached dwellings. This accords with to the findings above (table 3.6) as detached bungalows in Torbay will tend to have no more than 3 bedrooms.

| Bedrooms | Torbay no. | Torbay % | Exeter % | Plymouth % | England % |

|---|---|---|---|---|---|

| No bedrooms | 157 | 0.3 | 0.2 | 0.3 | 0.2 |

| 1 bedroom | 8,729 | 14.8 | 15.5 | 15.1 | 11.8 |

| 2 bedrooms | 18,626 | 31.6 | 27.6 | 29.6 | 27.9 |

| 3 bedrooms | 21,802 | 36.9 | 38.8 | 41 | 41.2 |

| 4 bedrooms | 7,334 | 12.4 | 12.7 | 10.3 | 14.4 |

| 5+ bedrooms | 2,362 | 4 | 5.3 | 3.8 | 4.6 |

| Total | 59,010 | 100 | 100 | 100 | 100 |

Source: Census 2011

Housing tenure

Table 3.8 below considers the tenure mix of the housing stock by occupied household space in Torbay. This is compared with percentage breakdowns in the comparative geographies.

The proportion of social rented housing in Torbay (8.1%) is significantly lower than in the comparative geographies. Clearly the low proportion of social housing stock will mean a lower proportion of social lettings available through relets, and hence a greater reliance on new affordable housing to meet affordable housing need.

The proportion of private rental housing in Torbay (23.2%) is higher than in the comparative geographies, and notably higher than in England as a whole. Given the low supply of affordable housing in Torbay, households on lower incomes are more likely to be reliant upon the private rental sector to meet their needs. We will explore this further in the next section.

| Tenure | Torbay no. | Torbay % | Exeter % | Plymouth % | England % |

|---|---|---|---|---|---|

| Household spaces | 59,010 | 100 | 100 | 100 | 100 |

| Owned | 39,424 | 66.8 | 59.8 | 58.7 | 63.3 |

| Shared ownership | 554 | 0.9 | 1 | 0.8 | 0.8 |

| Social (affordable) rent | 4,762 | 8.1 | 17 | 19.3 | 17.7 |

| Private rent | 13,696 | 23.2 | 21 | 20.2 | 16.8 |

| Living rent free | 574 | 1 | 1.2 | 1.1 | 1.3 |

Source: Census 2011

Age of housing stock

Table 3.9 sets out the age of the dwelling stock in Torbay. This data is informed by the Valuation Office Agency (VOA) data on council tax chargeable properties. This source of data we have referred to in table 3.6.

Torbay is characterised by a higher proportion of pre-1900 stock at 24.5% than its neighbours and

England as a whole. With just under 44% of the housing stock having been built before World War

2, this has implications for the overall condition, suitability and energy efficiency of Torbay’s housing stock.

Conversely, the proportion of dwellings dating from 1993 to 2019 is low in Torbay at 13.7%. This is marginally lower than for Plymouth but considerably lower than for Exeter which stands at 24.1%.

| Age | Torbay | Torbay % | Exeter % | Plymouth % | England % |

|---|---|---|---|---|---|

| Pre-1900 | 16,570 | 24.5 | 14.9 | 17.8 | 15.6 |

| 1900 to 1918 | 2,360 | 3.5 | 6.1 | 6 | 5.3 |

| 1919 to 1939 | 10,530 | 15.6 | 14.6 | 13.1 | 15.6 |

| 1945 to 1964 | 10,840 | 16.1 | 15.4 | 19.8 | 17 |

| 1965 to 1992 | 17,510 | 25.9 | 23.8 | 28.4 | 26.4 |

| 1993 to 2019 | 9,270 | 13.7 | 24.1 | 14.5 | 18.6 |

| Total | 67,500 | 99.3 | 98.9 | 99.6 | 98.5 |

Source: Valuation Office Agency 2019

Empty homes data

This chapter began by focussing upon the proportion and number of household spaces that were usually occupied or not. In summary, there were 5,360 household spaces at the time of the Census 2011 with no usual residents. At 8.3% of the total household spaces in Torbay, this is a significantly greater proportion than in the neighbouring urban areas and in England as a whole.

Household spaces with no usual residents are usually accounted for by the following factors:

- Second/additional private homes.

- Seasonal letting or holiday accommodation.

- Residential property that can be available to the residential market but are in fact not occupied, usually referred to as ‘empty homes’.

Empty homes are the category of ‘not usually occupied’ property where the local authority has the greatest opportunity to intervene and bring properties back into the active market.

It should be clarified from the outset that properties become empty for many reasons, most of which are legitimate. Examples include properties unoccupied pending sale, unoccupied pending probate or unoccupied for refurbishment. Such properties are part and parcel of a functioning housing market.

If, however, the percentage of empty homes is consistently higher than in corresponding areas, or if the number of long-term vacant dwellings (over 6 months empty) is consistently higher than in corresponding geographies, then this raises questions about the suitability and functionality of parts of the housing market. There is also the concern that properties that could potentially be used to meet the authority’s housing need are not available on the market.

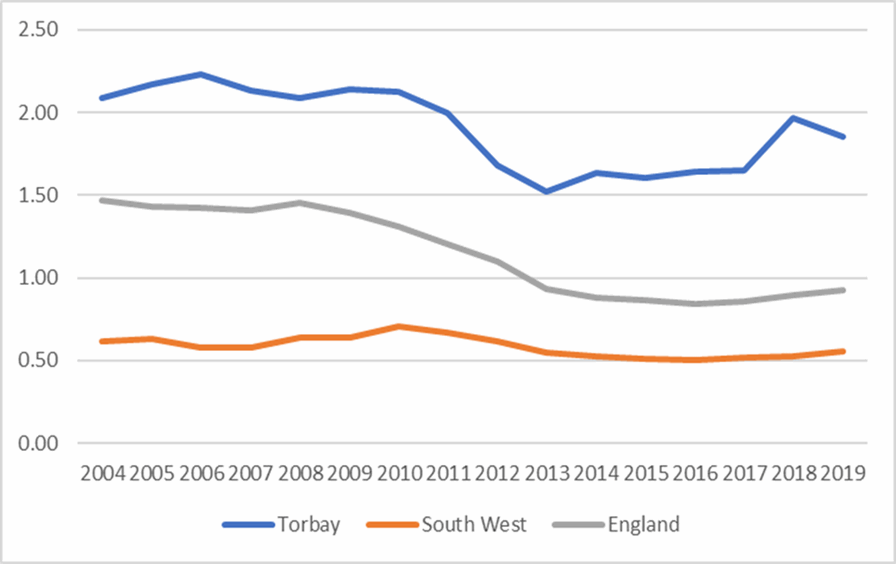

Between 2015-19 an average of 4.31% of Torbay’s housing stock was vacant, compared to 1.74% in the South West and 2.57% in England.

As illustrated in the graph below, Torbay also has had higher than average long-term vacancy rates since records began in their current form in 2004. At 2020 there were 1,134 long term vacant dwellings in Torbay, which represented 1.69% of the housing stock at the time. The overall average proportion of long-term vacant dwellings has fallen since 2011 but remains higher in Torbay at 1.74% of the stock since 2015 to 2019 compared to 0.52% in the South West, and

0.88% in England. This is illustrated below:

Figure 3.1: Long term vacancy rate

Source: DLUHC 2020

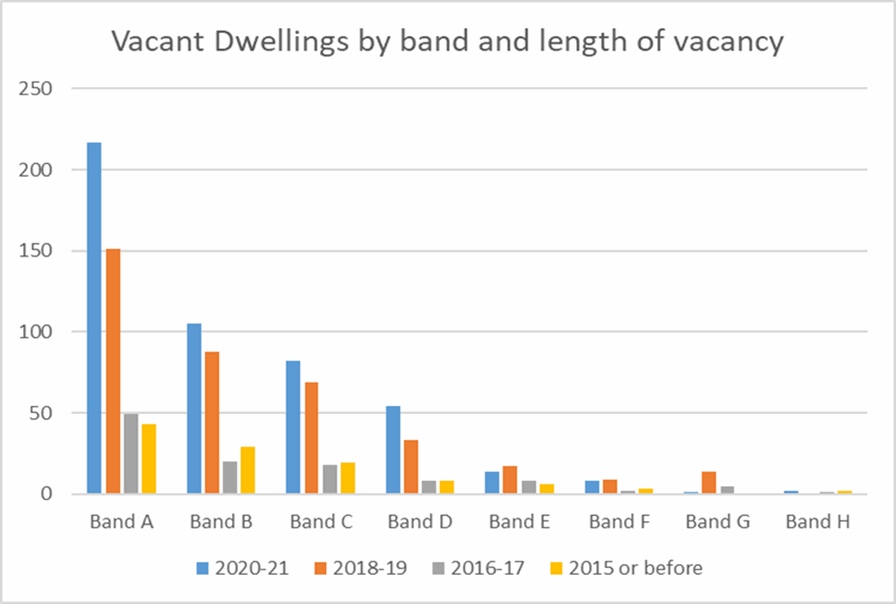

The graph below shows the relationship between council tax bands, long term vacancy rates, and the length of vacancy, with the data reflecting the period up to March 2021. Dwellings within the lower council tax bands, and particularly Band A, are more likely to be vacant and are vacant for longer periods than dwellings within the higher council tax bands. Band A would typically consist of flats in converted houses, other low value flats and some Registered Provider stock.

Figure 3.2: Long term vacant dwellings by council tax band

Source: Torbay Council 2021

The Council has a target to bring back into use some 150 empty properties per year. This is reflected in the current Local Plan. A Council report on empty homes “Vacant homes in Torbay” indicates that there is turnover within much of the long-term empty stock, but there is a lag in reoccupation. So the turnover rates are slow, particularly within Band A properties. There is an opportunity for the Council to consider some form of assistance to facilitate a higher turnover rate and thereby increase the overall supply of housing at any one time.

Houses in Multiple Occupation

Houses in Multiple Occupation (HMOs) are dwellings which are shared by multiple households. Typically, this will consist of bedsit accommodation with shared kitchen and bathroom facilities.

While HMOs may have a role to play as part of the suite of more affordable housing options servicing certain specific housing needs, HMOs can cause some concerns within communities as often tenants can be quite transitory and not vested into the local community. Certain areas in the country have seen a proliferation of HMOs and significant conversions of single household family accommodation into HMO accommodation. This has caused numerous low level anti-social behaviour issues within those communities.

This has occurred in many areas to accommodate the growth in student demand for accommodation. HMOs have often also become the only accessible accommodation for single people on low incomes or in receipt of benefits in many areas.

As can be seen from table 3.10, the number of both licensable and non-licensable HMOs is significantly lower in Torbay than across the comparative geographies, both in terms of numbers and proportion. Table 3.11 provides the proportion of HMOs within respective geographies relative to the whole housing stock and the private rental stock.

We have undertaken some consultation with the HMO officer to inform our analysis. Clearly one factor explaining the relatively low level of HMOs in Torbay is the lack of a student population. Both Plymouth and Exeter have established universities and are home to large populations of students.

Another important factor is that the lower end of the self-contained rental market in Torbay appears to be within the reach of people on lower quartile incomes, including those in receipt of housing benefit. Analysis within later sections of this assessment highlight that nearly 60% of private sector tenants are in receipt of housing benefit in Torbay compared to 22.6% and 32.2% in Exeter and Plymouth respectively. The previous section on empty homes also highlights the availability of lower value properties and possibly a degree of low demand for such accommodation. As such there is not the likely demand for HMOs given the lack of student accommodation and the relatively low rental costs within the lower quartile rental market. The

Council’s HMO officer confirms that there is not much investment interest in the HMO market in Torbay.

While the number of HMOs is relatively lower, Torbay has a far larger proportion of flat conversions than Exeter and Plymouth. The HMO officer indicates that there are significant numbers of ‘section 257’ properties, which refer to properties converted to self-contained flats outside of the prevailing building regulations of the time. Hence while the HMO count may be low, the number of poor quality flat conversions may present the same management challenges. There are clearly areas of the authority that have high proportions of low value rental accommodation which tend to dominate the area.

| Area | HMOs | Mandatory licensable | Licence issued |

|---|---|---|---|

| Torbay | 1,470 | 120 | 120 |

| Exeter | 4,412 | 1,300 | 1,252 |

| Plymouth | 5,000 | 1,300 | 1,219 |

| England | 510,277 | 134,353 | 77,762 |

Source: DLUHC Housing Statistical returns 2020

| Area | HMOs as % of occupied stock | HMOs as % of | Licensed HMOs as % of occupied | Licensed HMOs as % of PRS |

|---|---|---|---|---|

| PRS | stock | |||

| Torbay | 2.49 | 10.7 | 0.2 | 0.88 |

| Exeter | 8.96 | 42.7 | 2.54 | 12.1 |

| Plymouth | 4.57 | 22.7 | 1.12 | 5.53 |

| England | 2.31 | 13.7 | 0.35 | 2.09 |

Source: DLUHC Housing Statistical returns 2020; Census 2011

Environmental quality of the housing stock

This section considers the energy efficiency of Torbay’s housing stock. The Standard Assessment Procedure (SAP) is the methodology used by the Government to assess and compare the energy and environmental performance of dwellings. The SAP assessment is used to calculate the Energy Performance Certificate (EPC) for homes. The EPC comprises a numerical score from 1100 SAP points. These scores are divided into bands as follows:

- EPC rating A = 92-100 SAP points (most efficient)

- EPC rating B = 81-91 SAP points

- EPC rating C = 69-80 SAP points

- EPC rating D = 55-68 SAP points

- EPC rating E = 39-54 SAP points

- EPC rating F = 21-38 SAP points

- EPC rating G = 1-20 SAP points (least efficient)

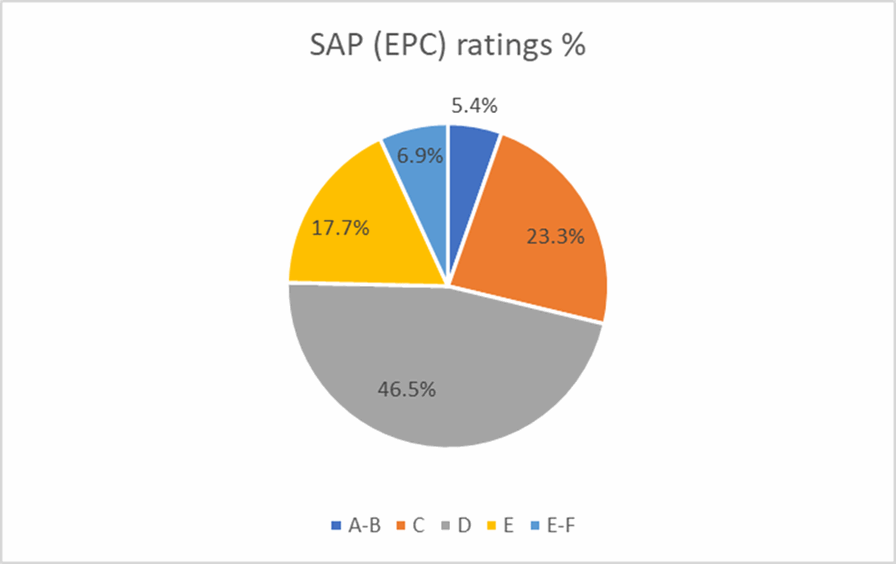

Data from EPC records has been collated by the Energy Savings Trust and provided in order to enable an assessment of the energy efficiency of Torbay’s housing stock. The data for Torbay records 181 ‘unknown’ properties. We have discounted these for the purposes of this analysis. The pie chart below (figure 3.3) shows that 70.5% of the housing stock in Torbay is rated band D or lower with just 5.4% of the stock in bands A or B.

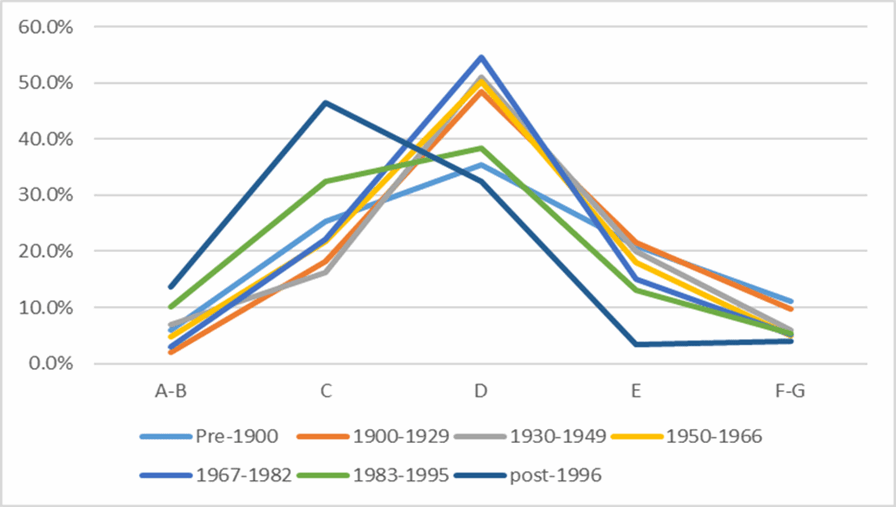

Figure 3.4 SAP rating band by age of dwelling

Source: Energy Savings Trust 2021

Figure 3.4 illustrates the proportion of dwellings in each SAP rating band by age of dwelling. Dwellings built post-1996 are weighted toward the higher rated SAP bands, showing the highest proportion of A-B and C rated dwellings. In fact, the dwellings built post-1996 are the only grouping where the highest proportion of dwellings are rated band C. Properties built between 1900 and 1982 all show a similar distribution across the respective bands.

Dwellings built between 1983-1995 and pre-1900 show a different distribution compared to the other groupings of dwellings built pre-1996. While these groupings still have the highest proportion of dwellings in Band D, it is relatively lower than the other pre-1996 groupings and the proportion of dwellings in Band C is relatively higher. The 1983-1995 grouping has the second highest proportion of dwellings in Band A-B after post-1996 dwellings. It is interesting that pre-1900 dwellings outperform some post 1945 groupings.

Source: Energy Savings Trust 2021

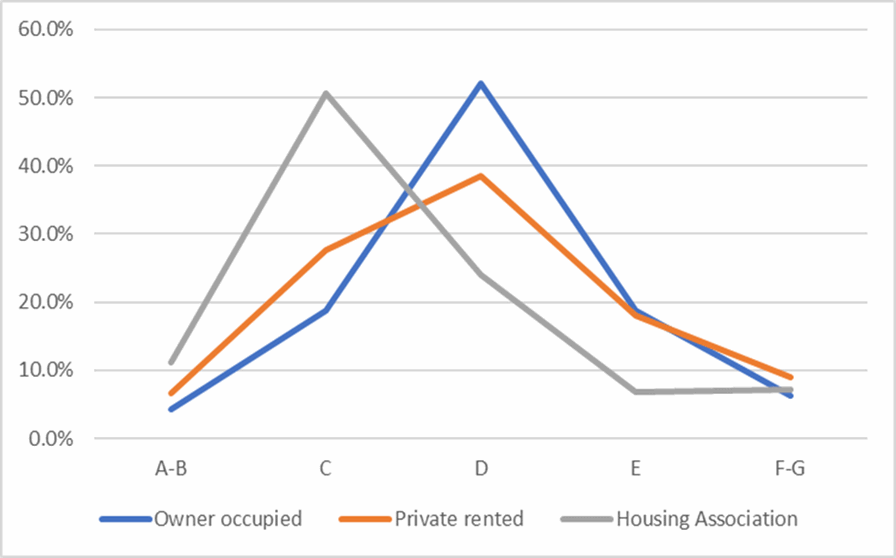

Figure 3.5 illustrates SAP rating bands by tenure of dwellings. The greatest proportion of Housing Association (or Registered Provider) dwellings, which includes the former council owned stock, sit within SAP banding C. Affordable housing stock is required to a meet a Decent Homes standard and, up until 2015, new affordable housing was required to meet higher environmental standards than market housing. The table below also shows that the private rental sector has a higher proportion of Band A-B and Band C rated dwellings than the owner-occupied sector. Conversely the private rental sector shows a marginally higher proportion of F-G rated properties at just under 10%. All rented properties, with a few exceptions, must meet EPC band E as a minimum.

However, there are a small but significant number of rented dwellings that are below EPC band E. All affordable housing stock will need to meet EPC Band C by 2030 and this will be supported by the Social Housing Decarbonisation Fund.

Figure 3.5: SAP rating band by tenure

Source: Energy Savings Trust 2021