- Introduction

- Budget Overview

- COVID-19

- Capital Plan 2022/23

- Spending Round 2021 and Local Government Finance Settlement 2022/23

- Formula Funding and Business Rates Consultations

- Dedicated Schools Grant

- Adult Social Care

- Children’s Services

- SWISCo

- Estimation of Council Tax Surplus/Deficit

- National Non-Domestic Rates

- Council Tax and Referendum Limits

- Pay and Pensions

- Services Grant

- Reserve Levels

- CIPFA Financial Resilience Index

- Longer Term Future Council Funding

Introduction

- This report by the Council’s Chief Finance Officer provides further information to support the Partnership’s Budget for 2022/23.

- This report aims to provide further information and an overview of several key factors, including several “technical” finance issues, that have influenced the 2022/23 budget and raises issues for future financial years.

Budget Overview

- The budget is presented for a second year presented in the light of financial uncertainty from the ongoing COVID-19 health pandemic.

- It is estimated that the financial impact of COVID-19 will be ongoing but with a reduced impact on the 2022/23 budget. The impact on the Council’s income, expenditure and funding is outlined in the Medium-Term Resource Plan and the 2022/23 budget proposals. Clearly the financial impact on 2022/23 and future years can only be an estimate and officers will continue to update estimates and will continue to aim to mitigate as far as possible any financial impacts.

- The local government finance settlement, (final issued in February 2022), confirmed there were no new allocations of funding to councils planned for the impact of COVID and no extension of the sales fees and charges compensation scheme. DHSC have now confirmed that any unspent Contain Outbreak Management Funding can be carried forward into 2022/23.

- The current inflationary pressures on services and providers are the highest they have been for several years. In addition to the employers’ National insurance increase of 1.25% from April 2022 there has been high utilities and fuel inflation, higher levels of CPI inflation (5.5% in January 2022) and increases in the Living Wage. This is an area of concern, and as a result in mitigation the Council has increased its inflation provision in 2022/23, however the actual financial impact will not be known until during 2022/23.

- The impact of inflationary cost pressures and supply chain issues are also likely to increase costs, and potentially impact on the viability, of capital projects. As a result, a capital contingency has been included in the 2022/23 budget.

- 2019/20 was the final year of a four-year funding settlement. As context Torbay’s Revenue Support Grant has reduced from £42m in 2013/14 to £6m in 2019/20.

- The 2022/23 Local Government Finance Settlement was confirmed in February 2022 and was like the previous two years, i.e., a one year only “roll over” settlement, with the Revenue Support Grant at £6.8m, with additional grant allocations for social care and a one off “Services grant” allocation. Consequently, there is still considerable funding uncertainly from 2023/24 onwards. In addition, DLUHC, for a third year, further delayed the introduction of a new funding formula and a revised NNDR system to April 2023 at the earliest.

- The Council’s financial planning for 2022/23 started in March 2021 and the Partnership’s provisional budget proposals were delayed until after the Provisional 2022/23 Local Government Finance Settlement given the extent of the uncertainty in what it would contain. The Partnerships proposals were then published on 11 January 2022, enabling a period for consultation and scrutiny of the proposals.

- The Council was permitted to carry forward any specific 2020/21 collection fund losses to be funded over the following three financial years. The Council transferred funds in 2020/21 to an earmarked reserve which covers this deficit over three years with 2022/23 being the second year.

- It is proposed by the Partnership that the Council increases its Council Tax requirement by an inflationary 1.99%.

- In addition, it is proposed to increase Council tax specifically for Adult Social Care by a further 1% in 2022/23.

- Members of the Overview and Scrutiny Board (through the Priorities and Resources Review Panel) examined the proposals and stakeholders, and residents have had the opportunity to make representations on the proposals through the consultation. The Partnership have reviewed the responses received and the final budget proposals are drawn up after consideration of the responses.

- This report supports the Revenue Budget 2022/23. Other budget related reports will be presented to Council in March 2022 which are relevant to the Council’s overall financial position are:

- 2022/23 Capital Strategy and Capital Receipts Strategy,

- 2022/23 Treasury Management Strategy, including Investment Policy and Minimum Revenue Provision Policy,

- 2022/23 Review of Reserves,

- Also relevant are:

- Medium Term Resource Plan,

- Corporate Asset Management Plan,

- 2021/2 Revenue and Capital Budget Monitoring Reports.

- Budget Digest pages, Fees and Charges and budget proposals sheets are available separately along with any relevant equalities impact assessments.

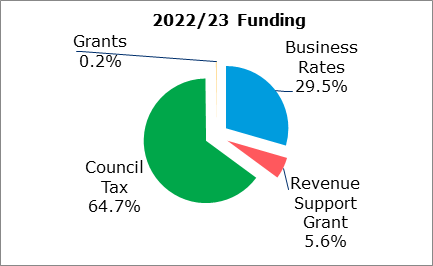

- A summary of the Council’s 2022/23 budget is as follows:

| Source | Percentage |

|---|---|

| Grants | 0.2% |

| Business Rates (NNDR) | 29.5% |

| Council Tax | 64.7% |

| Revenue Support Grant | 5.6% |

- A summary of the proposed 2022/23 budget by Service area is shown in the table below.

| 21/22 £m | Source | Net £m |

|---|---|---|

| 74.6 | Council Tax | 78.1 |

| (1.4) | Collection Fund Surplus (Deficit) | 0.1 |

| 6.6 | Revenue Support Grant | 6.8 |

| 33.7 | Business Rates (NNDR) | 35.6 |

| 2.0 | Other General Grants | 0.2 |

| 115.5 | Total | 120.8 |

| 21/22 £m | Directorate/Service | Expenditure £m | Income £m | Net £m |

|---|---|---|---|---|

| 41.9 | Adult Services | 60.2 | (16.5) | 43.8 |

| 3.1 | Community and Customer Services | 45.5 | (42.9) | 2.6 |

| - | Housing benefit included in Customer Services | 37.0 | -41.4 | 0 |

| 45.0 | Sub Total - Adult Services | 105.7 | 46.1 | |

| 45.7 | Children's Services | 106.9 | (61.1) | 45.8 |

| - | Dedicated Schools Grant included in Children's Services. 2022/23 (estimated) | 47.1 | (47.1) | 0 |

| 9.7 | Public Health | 10.4 | (0.3) | 10.1 |

| - | Corporate Services | 9.3 | (2.9) | 6.4 |

| - | Chief Executive's Unit | 4.8 | (1.2) | 3.6 |

| 8.7 | Sub Total - Corporate Services | 14.1 | (4.1) | 10.0 |

| (9.6) | Finance | 30.7 | (38.5) | (7.85) |

| (4.6) | Investment Properties | 9.5 | (14.1) | (4.6) |

| 20.6 | Place Services | 43.6 | (22.6) | 21.0 |

| 115.5 | Total | 320.9 | (200.1) | 120.8 |

COVID-19

- The financial impact of Covid-19 has constantly evolved during the 2021/22 financial year and will continue to change.

- In 2021/22 the Council received £5.9m of one-off funding to reflect the impact of COVID. This support will not occur again in 2022/23 and at this stage there have been no announcements of any such funding for 2022/23 nor any income loss compensation.

- The Council Tax Support Scheme is to support residents with their Council Tax bills. For working age claimants, the level of support is linked to their household income. Since March 2020 with the start of “lockdown” and its economic impact, the number of claimants for this scheme has increased. These costs and other impacts on the Council’s tax base was estimated at £0.750m (a 1% impact on total Council Tax income) which was part of the 2022/23 taxbase calculation.

- In the current year, up until December, we have seen a cash reduction of 1.6% in collection of Council Tax compared to pre COVID levels. The ongoing impact on the collectability of Council Tax in 2022/23 due to the economic conditions has been estimated at 1% i.e., £0.750m.

- In the current year, we have seen an ongoing reduction in collection of NNDR. Two thirds of Torbay businesses are in retail, leisure or hospitality and given the current economic conditions, the ongoing impact on the collectability of NNDR in 2022/23 has been estimated at £0.5m.

- The Council has outsourced the contract for the Riviera International Conference Centre however it is unlikely to achieve historic income levels for up to two years. As a result, £0.5m has been estimated as the deficit funding required in 2022/23 for the Riviera International Conference Centre.

- The economic impact of Covid-19 is likely to lead to a continued increase (compared to pre COVID levels) in levels of homelessness. This impact has been forecast at £0.5m.

- The Council receives an income from properties held for regeneration and investment purposes (such as Fleet Walk and Wren Park). While any rental shortfall on such properties would initially be met from the relevant earmarked reserves there is likely to be an ongoing overall impact on rental income. Therefore, a contingency of £0.2m for rental income losses has been included.

Capital Plan 2022/23

- As required by the Council’s Constitution, the Capital Plan for 2022/23 has been published which is line with the latest budget monitoring position with the addition of three new capital schemes for 2022/23. As the Council has a rolling four-year Capital Plan that is reported quarterly, the Capital Plan for 2022/23 is a “subset” of the four-year plan based on the latest monitoring information.

Spending Round 2021 and Local Government Finance Settlement 2022/23

- The Chancellor announced a three-year Spending Review in October 2021. This announced the total allocations for government departments. For local government the allocation of this total is in the subsequent local government finance settlement.

- In the Spending Review the total for local government increased by £1.6 billion. The second two years of the Review (23/24 and 24/25) however are at the same “cash” level as 2022/23. The absence of any additional funding in the second two years is a significant concern as this does not provide funding for any demand growth in services, such as social care.

- The 2022/23 settlement is fundamentally a one year “roll over” from 2021/22. The Council’s core funding of Council tax will increase by 1.99% and other core funding will typically increase by 3.1% for inflation (based on September CPI). Other service grants in 2021/22 were also rolled over into 2022/23. The 2022/23 Public Health grant allocation was also increased in line with September CPI with inflationary increases indicated for future years.

- As expected, the referendum limit for council tax rises was set at 2%. In addition, the flexibility for Councils to raise council tax by a further 1% specifically for adult social care was confirmed for 2022/23 and the following two years. These council tax increases are “assumed” as part of the increase in councils’ “core spending power” often quoted by DLUHC.

- The Social Care grant was also increased year on year by £2.3m. This additional funding will be used to support provider and other inflationary costs in these services.

- A new “one off” Services Grant of £2.2m was announced. The Partnership has chosen to apply this funding to one off allocations rather than fund ongoing costs from one off income. DLUHC have been clear that this grant allocation will not form the part of any baselines for any funding changes, and they will consider the future allocation of this funding.

- No additional funding was announced for the ongoing impact of COVID.

Formula Funding and Business Rates Consultations

- DLUHC’s aim of implementing a new funding formula and a revised business rates retention system (both last updated in 2013) has now been delayed for a third year to 2023/24 at the earliest. Progress to a new funding formula has not significantly advanced since the two consultation documents issued in December 2018. There is therefore still significant uncertainly around the Council’s funding for 2023/24 onwards.

- As the Services Grant was allocated for one year only and the fact that there was only a one-year funding settlement despite a three-year Spending Review strongly suggests that in 2023/24 a redistribution of council funding is likely to happen.

- Key elements of the previous consultation were:

- New funding formula to allocate new funding baselines and income baselines to all councils. The aim was to have as simplified a formula as possible that focusses on a limited number of key cost drivers. The consultation proposed an eight-block formula then adjusted for general factors to reflect labour costs, rates costs and sparsity.

- There are seven specific formulas for major services – adults social care, children’s’ social care, highways, public health, legacy capital costs, fire and flood defence. All other services will form part of a “Foundation” block where it is proposed that this formula will be based on total population.

- This proposal, although meeting the criteria of being transparent and simple, does not take into account other place-based factors that can influence costs and demand such as deprivation and coastal town issues. Also, some services included in the Foundation block such as concessionary fares, home to school transport and housing/homelessness are clearly not linked to total population.

- DLUHC have said that they will look in 2022 to revisit the previous consultations in the light of any potential ongoing impacts of COVID.

Dedicated Schools Grant

- The Council will, as usual, direct the entire grant received in respect of Dedicated Schools Funding through to those areas defined in the School Finance Regulations. The estimated value of the Dedicated Schools Grant (DSG) before academy school recoupment is £124m. For 2022/23 it is estimated that approximately £47m will be retained in the Council’s budget for expenditure related to its (maintained) schools and other residual functions including education for High Needs.

- The DSG and the schools funding formula is expected to change with full introduction of a new national (simplified minimum per pupil) school funding formula, however, there has been no confirmation of when this change will be implemented by the Education, Skills and Funding Agency (ESFA). Movement of funding between these blocks is now limited and is expected to cease altogether for the schools’ block with the introduction of the national school funding formula.

- The key financial pressure within the DSG is in the High Needs block. The pressures on the High Needs Block arise from the level of demand and referrals from schools and other agencies for support to pupils with additional needs. In previous years, in recognition of this pressure, Schools Forum agreed to move 0.5% out of the Schools Block to help fund the increased demand within the High Needs Block. Schools Forum has not agreed to this virement for 2022/23. The overspend on the DSG in 2021/22 is estimated to be £3.3m, resulting in a cumulative forecast deficit of £9.125m, which under current regulations needs to be “made good” in future years from the Dedicated School Grant allocations.

- This rising deficit is a key issue for the school’s community and the Council. At this stage a balanced budget is still not forecast nor currently achievable, and therefore the deficit will continue to rise. The level of the deficit as at end of March 2022 is forecast to be in excess of the Council’s general fund reserve, by more than £3m.

-

Until the High Needs Block achieves financial balance in the longer term, the DSG reserve will be used to fund the cumulative deficit as a “negative reserve”. Under legislation until the end of 2022/23 this reserve can be re-classified on the Council’s balance sheet as a usable reserve. However, holding a negative reserve or even reclassifying it is not a sustainable solution.

-

Although legislation at present requires this deficit to be funded from the Dedicated Schools Grant, the higher the deficit increases without any funding solution there is clearly a rising financial risk for the Council and the schools in Torbay. Inevitably if there is a risk that the council will have to fund this deficit then the fundamental financial impact on the Council will result in a Section 114 notice being issued and service and school spend being reduced or stopped.

- On the 17 February 2022 the Council was informed by the Department of Education that “your authority will shortly be invited to take part in the ‘safety valve’ intervention programme with the DfE in 2022-23 financial year. The aim of the programme is to agree a package of reform to your high needs system that will bring your dedicated schools grant (DSG) deficit under control”. Although the details of the consequences of the intervention are unknown, this letter at this stage can only be welcomed.

Adult Social Care

- The Council’s budget proposals for 2022/23 includes the contract sum agreed with the ICO and CCG to continue the highly regarded system of integrated health and adult social care within Torbay. This is the third and final year of the current three-year arrangement, supported by a focussed cost improvement plan for adult social care. The contract value for 2022/23 is £47 million.

- Any additional funds raised by the 2022/23 Council tax precept of 1% (approx. £0.750) have been earmarked for adult social care.

- The Council has been in forms of integrated health and adult social care arrangements since 2005 with the CCG (Clinical Commissioning Group) and the ICO (Torbay and South Devon NHD Foundation Trust). The current financial arrangement expires in March 2023. To provide financial and service certainty to all parties, negotiations have been ongoing to extend the current arrangement for a further two years for 2023/24 and 2024/25.

- All three parties are committed to the continuation of the successful integrated arrangement continues, and a two-year extension has been agreed subject to approval by the relevant formal approvals of each party. Therefore, Council is recommended that to ensure the continuation of the integrated health and adult social care arrangements with the CCG and the ICO for a further two financial years to 2025, that the Council allocate funding of £55.4m for 2023/24 and £56.5m for 2024/25.

- To support integrated health and adult social care improvements the CCG and the Council will agree a s256 Health Act 2006 “joint working agreement” with the CCG providing £10m of funding to support in 2021/22. This funding will be recognised in 2021/22 and then carried forward to support related expenditure over the next three years.

- Officers fully support the proposals and consider the funding allocations for 2023/24 and 2024/25 a “fair and robust” position for the Council and enables financial certainty for the Council for these years for this vital service.

- The Government has introduced an increase in employer and employee national insurance contributions from April 2022 as a Health and Social Care levy to fund changes in those services. In the Spending Review it was announced that for the first three years the majority if this funding (85%) would be allocated to the NHS. Of the 15% for social care. Of this 15% approximately 2/3rd will be allocated direct to local government over the next three years with the national allocations over the three years being £0.2b, £1.4b and £2b.

-

The Councils allocation in 2022/23 is £0.559m and has been allocated as the Market Sustainability and Fair Cost of Care Grant. DHSC have stated that “the 2022/23 funding is designed to ensure Councils can prepare their markets for reform and move towards paying providers a fair cost of care, as appropriate to local circumstances”. The Council will earmark this grant for the identified purpose.

-

It should be noted that any new funding and cost implications of the Adult Social Care “white paper” and any funding from the Health and Social care levy allocated by the Market Sustainability and Fair Cost of Care grant is outside the current future ASC proposal due to the ongoing uncertainly of the new requirements. Full detail of the changes to adult social care to be funded from the Levy are yet to be announced. There is a government “white paper” and more detail expected during 2022.

Children’s Services

- As Council is aware an additional £7m was added to the children’s social care budget in 2020/21 to re base the budget to reflect demand levels allowing for a contingency for demand. In addition, £2m was allocated to the service to enable investment in areas to enable service improvements. Areas for investment included SEND, senior management capacity, commissioning, procurement, recruitment and retention, social work academy, and investment in fostering in particular for carers who look after children with complex needs.

- As a result of these investments and improvements within the service itself, the outturn in 2020/21 was below budgeted levels. The 2021/22 budget was reset at a level that reflects the lower levels of cost allowing a contingency for higher numbers of looked after children.

- For 2022/23 there is expected to be further financial gains primarily from a lower level of exceptional costs in the service and reductions in the total cost of staffing as the success of the learning academy and recruiting permanent posts will reduce the level of agency staff required. The Childrens budget is however subject to cost and demand variations from the numbers and provision for looked after children. To mitigate this risk a new earmarked £1m reserve will be established.

- Within the 2022/23 budget there is an allocation of £400k for investment in the SEN service to deliver improvements in the service and £100k investment in youth services.

SWISCo

- The budget proposals include a £1.5m reinvestment in the SWISCo budget to “rebase” to reflect actual levels of cost and income. The aim of this is to provide adequate funding for SWISCo going forward. Future budgets should then be linked to inflation, property growth and any service changes the Council may wish to implement.

Estimation of Council Tax Surplus/Deficit

- The Council makes an estimate of the surplus or deficit on the Collection Fund at year end, from under or overachieving the estimated council tax collection rate. This would historically be a surplus figure of approximately £1.7m.

- COVID-19 has had a significant ongoing impact on the collection of council tax. The 2021/22 position is better than 2020/21 but lower than pre COVID levels. Consequently, the Council will recognise a surplus in 2022/23 of £0.8m.

- As the Council sets a collection rate within its tax base equivalent to the amount collected in the 12 months of the next financial year any surplus primarily represents the collection of sums due in respect of previous years. This indicates a level of success in collecting old year debts and raises the overall, longer term, collection rate well above the “in year” rate. Historically the Council has assumed a 96% in year collection rate which has been re-established for 2022/23 however a value equivalent to 1% will be held in contingency for potential losses in 2022/23.

- The ongoing economic impact of COVID on Torbay residents combined with “cost of living” increases from national insurance rises, fuel and utility costs could result in more Torbay residents facing financial hardship which the Council will continue to be mindful of.

- As a local precepting authority, as defined in the Local Government Finance Act 2012, Brixham Town Council will not be required to fund any deficit, nor will they be entitled to a share of any surplus on the collection fund.

National Non-Domestic Rates

- The Council’s NNDR income in 2022/23 comprises three parts: a 49% share of NNDR income, a “s31” grant to reflect the loss of NNDR income to the council from central government changes to the NNDR (e.g., SBR) and a Top Up grant that reflects the difference in the Council’s assessed “need” for funding compared to its actual ability to raise NNDR income (as set in 2013).

- Since the introduction of the Business Rates Retention Scheme in April 2013, the Council is also required to declare a surplus or deficit for NNDR in a similar way as set out above for council tax. The forecasting of NNDR has involved a wide range of complex variables and influences such as from reliefs and is an area which causes complications for medium term financial planning.

- However, with the economic uncertainty likely to negatively impact the collection rates from COVID, the collection rate for NNDR in 2022/23 has been assumed to be improved compared to 2021/22 but lower than 2019/20. There is a new COVID related business rate relief scheme for 2022/23 along with a freeze in the NNDR multiplier. The Council will continue to be compensated for this loss of NNDR income.

- DLUHC have delayed the implementation of a revised NNDR retention scheme to at least 2023/24 and have also now confirmed that a “reset” of NNDR baselines to reflect growth since 2013 has also been delayed.

- The Council along with other Devon Councils will continue with a NNDR pool for 2022/23 with an estimated gain to Torbay of £0.9m. The future of pools and the resulting financial gains are not certain under any new NNDR system from 2023/24.

Council Tax and Referendum Limits

- To control the level by which local authorities can increase Council Tax, the Government has set limits at which point a referendum would be required. This was set again at 2% or over for 2022/23. The Partnership’s budget is for a 1.99% increase in this element. In addition, DLUHC have offered Councils the flexibility to increase council tax by a further 1% for Adult Social care and the budget includes an additional 1% for this specific purpose.

- Council will be aware that the Council Tax bill sent out to residents is made up of three main component parts, namely Torbay Council (including Brixham Town Council), Devon and Cornwall Police Authority and Devon and Somerset Fire and Rescue Authority. Once these have been declared they will be included in the Council Tax setting report which will be presented to the Council in March 2022.

- The Secretary of State will consider the three component parts, not the overall bill, and, if any one of the three organisations were capped, the Council would have to re-bill.

- In 2021/22, Torbay had the lowest Band D Council Tax in Devon at £1,967.56 including the Fire and Police precepts but excluding parish and town council precepts.

| Type | Torbay (Unitary council) | Plymouth (Unitary council) | Exeter (City Council) | South Hams (District Council) | Teign-bridge (District Council) |

|---|---|---|---|---|---|

| District Council | - | - | £165.05 | £175.42 | £180.17 |

| Devon County | - | - | £1511.28 | £1511.28 | £1511.28 |

| Total | £1641 | £1654.35 | £1676.33 | £1686.70 | £1691.45 |

| Fire and Police | £326.56 | £326.56 | £326.56 | £326.56 | £326.56 |

| Band D (excluding parish precepts) | £1,967.56 | £1979.91 | £2002.89 | £2013.26 | £2018.01 |

- The differential between Torbay and the other Councils increases when Town and parish precepts are added. As a guide the 2021/22 precept for Brixham Town Council was £58.09.

Pay and Pensions

- The 2021/22 pay award for staff (current employer offer is 1.75%) has not yet been agreed which provides uncertainty for the current year and 2022/23. The 2022/23 budget assumes a 2% pay award while a contingency will be s held if the pay awards are higher along with any impact of the living wage and/or increases on lower grades over the “headline” award.

- From April 2022 there is a 1.25% increase in the Council’s employer national insurance contributions which has been provided for. It was announced that Councils would receive compensation for this cost however no specific funding for this has been announced for 2022/23.

- There will also be a similar pressure from this rise on the Council’s suppliers and subsidiary companies.

- In 2019 there was the triennial valuation of the Devon County Pension Fund to ensure that employer contribution rates are set for the following three financial years to meet the long-term employee pension benefits requirements. This from 2020/21, for three years, resulted in an increase in Torbay’s “primary” rate to 16.7% (from 14.8%), this increase has however been more than offset by a significant reduction in the Council’s “secondary” rate (i.e., deficit) lump sum payment

Services Grant

- The Partnership’s proposed allocation of the one-off £2.243m Services Grant in 2022/23 is as follows.

| Allocated to | Amount |

|---|---|

| Investment in SWISCo including digitisation | £0.428m |

| Investment in SEN | £0.400m |

| Investment in “Premier Resort” | £0.500m |

| Investment in Capacity to deliver projects | £0.500m |

| Investment in Planning Service | £0.200m |

| Investment in Climate Change | £0.100m |

| Community Ward Fund | £0.072m |

| Support for (potential) Devon Deal | £0.043m |

Reserve Levels

- The Council’s general fund reserve of £5.6m as at the end of 2020/21 is at a level that is close to 5% of the Councils net budget. The Partnership have been supportive by increasing this balance to a level that is close to 5% of the Councils net budget.

- By achieving a general fund level of 5% is prudent for the Council and this will be the first time in a long period this level has been achieved. As a guide in 2004/05 the level was 2%, in 2010/11 level was 3% and in 2019/20 the level was 4%.

- The 2022/23 budget does not include any use of any earmarked reserves to fund “base budget costs to achieve a balance. Earmarked reserves are being used to fund the three-year impact of the collection fund deficit and to cover some COVID related costs that are not expected to be permanent.

- The Council continues to have the option, to give reserve levels a “boost”, to swop revenue and reserve funded capital expenditure for prudential borrowing up to £3m which will need to be funded from future revenue budgets. At this stage this option is not being proposed.

CIPFA Financial Resilience Index

- To provide more information and transparency on Councils’ financial position, CIPFA issue a “Financial Resilience Index” to provide information which is available on their website.

- The Index shows the assessment (based on 2020/21 data) of Torbay’s position is that the “Indicators of Financial Stress” rank Torbay as a “higher risk” Council but not at the highest level. Factors that show a higher risk assessment are in relation to children’s’ social care where the council’s share of its budget on this service is high and it has an inadequate OFSTED judgement. In addition, the Council’s level of borrowing (linked to its investment property purchases) and therefore its interest costs are higher risk than average.

Longer Term Future Council Funding

- The Medium-Term Resource Plan was updated at the end of March 2021 to include the impact of COVID-19 and the delays in the implementation of the new funding formula and revised NNDR retention system. The three-year 2021 Spending Review announced in October 2021 was followed up by just a one-year Local Government Financial Settlement which does not help with longer term financial certainly over future funding.

- DLUHC’s aim of implementing a new funding formula and a revised business rates retention system (both last updated in 2013) has now been delayed for a third year to 2023/24 at the earliest. Progress to a new funding formula has not significantly advanced since the two consultation documents issued in December 2018.

- As the Services Grant was allocated for one year only in 2022/23 and there was only a one-year funding settlement despite a three-year Spending Review does strongly suggest that in 2023/24 a redistribution of council funding is likely to happen.

- As an initial guide, prior to more detailed work being undertaken post 2022/23 budget setting, it is estimated that for 2023/24 and 2024/25 the Council will require in the region of over £9m of reductions to achieve a balanced budget. In addition to the funding uncertainty, the Council’s three-year agreement with the ICO for adult social care will need to be renegotiated for 2023/24 and there will be a pension revaluation which will be implemented from 2023/24.