Overview

The Council recognises that holiday homes may appear empty, however ‘a long-term empty home’ is defined by Government as 'an unoccupied, unfurnished property for a period of six months or more'. This is a working definition, and a property may be deemed to be unoccupied where any use is transitory, or intermittent. In these situations, each case will be assessed individually.

Homes may become empty for several reasons; in most cases they are empty for a temporary, short-term situation, for example awaiting sale, letting, or being renovated prior to occupation. For this reason, homes empty for under 6 months are not classed as ‘long term empty homes’. These homes are not recorded as government data, but are recorded locally because, as a local authority, we charge 100% Council Tax on properties from the day they become empty.

Empty over 6 months

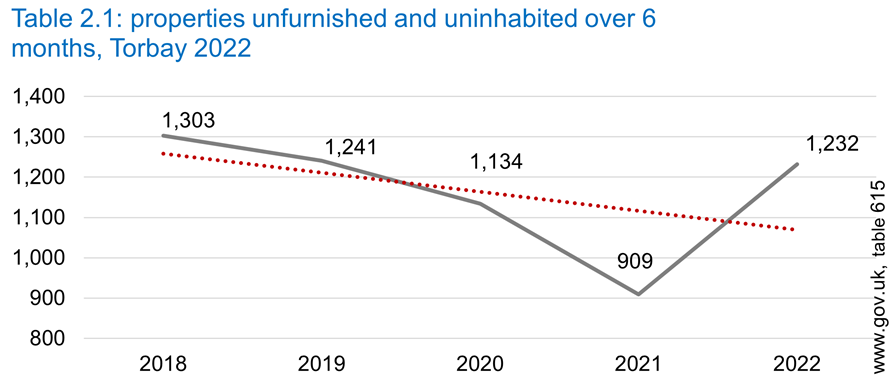

The number of empty homes changes all the time, but the number of properties ‘Class C; unoccupied and unfurnished over 6 months’ is recorded by government as a snapshot on 1 October each year.

Since 2018 Torbay has seen a general decrease in the number of empty homes, however, numbers have recently increased. On average, there are 1,164 empty properties in Torbay that are empty for more than six months. This represents 1.8% of the housing stock.

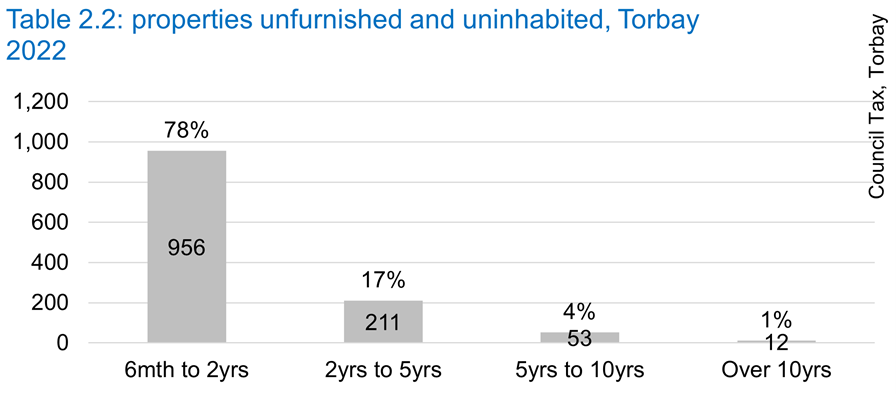

Empty under 2 years

When a dwelling becomes unoccupied and unfurnished it is generally because it is being made ready for sale, letting, or is being refurbished. These dwellings will generally fall back into use in a timely fashion with no Council intervention. However, some properties may take up to two years to become occupied, depending on the legal, financial and personal circumstances of the property and/or owner, for example, some are exempt due to probate etc. Whilst these properties are recorded as ‘long term empty’, and their circumstances are taken into consideration, they too will often return into use with minimal intervention from the Council.

Empty over 2 years

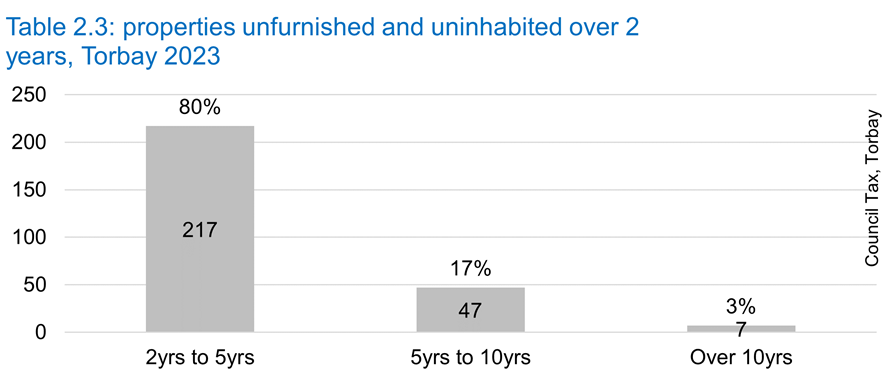

Local authorities generally focus time and energy on dwellings that have been empty for over two years. These properties, and their owners, often exhibit more complex issues that have a direct influence on whether the property is brought back into use. It is these properties that may require intervention, whether it be support, or legal action, however it should be noted that in most cases, protracted legal encounters are not cost effective and are a drain on public finance.

Additionally, longer term, empty homes are of interest to the Council because they are a wasted resource and can sometimes be in a dangerous state, detrimental to the street scene, or a source of serious nuisance to those who live near them, for example harbouring vermin, or by being used for anti-social activities. Additionally, in criminology, the ‘broken windows theory’ states that visible signs of dereliction, abandonment, and anti-social behaviour, create a spiralling urban environment that encourages further dereliction, abandonment, and anti-social behaviour, even crime.

Under current legislation local authorities can charge additional Council Tax on homes that are long term empty over 2 years. In Torbay we currently charge twice the amount of Council Tax, which then rises over time, should the property remain empty, as discussed in Section 2.4

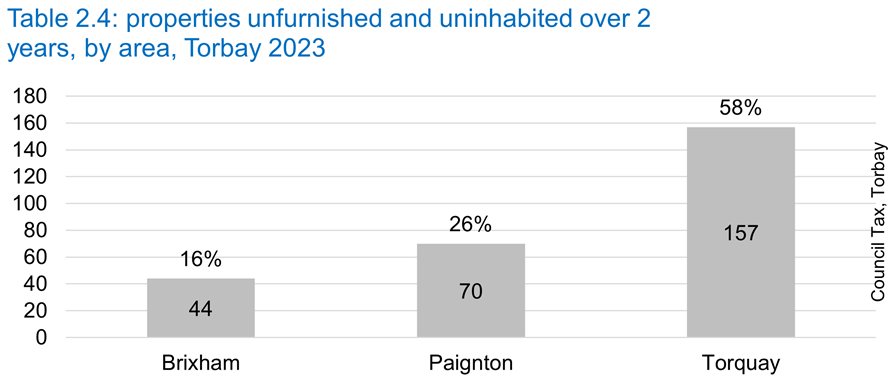

As of March 2023, 271 dwellings in Torbay were ‘uninhabited and unfurnished’ for longer than 2 years.

Council Tax premiums

To encourage owners to bring properties back into use Torbay Council charges full Council Tax allowable under the law on properties from the day they become empty. However, additional premiums are applied once properties, falling outside of exemption categories, have been empty for over 2 years.

Additional empty property premiums are charged on a sliding scale, depending on how long the property has been empty:

- 2 years + twice the annual charge (100% premium)

- 5 years + three times the annual charge (200% premium)

- 10 years+ four times the annual charge (300% premium)

Once a premium is levied, a revised bill is generated to let the owner know the charge has increased. We also write to owners outlining the importance of bringing empty homes back into use, outlining what support they can expect from the Council. Owners will continue to receive a letter each time the premium is increased.

The empty homes premium is placed upon the property, not ownership, therefore, any transfer of ownership does not affect the date the premium charge becomes due. For example, if a property has already been empty for more than 2 years on the date purchased, the new owner will have to pay the appropriate premium from the date of purchase.

Empty property premium - Torbay Council

Subject to the emerging ‘Levelling-up and Regeneration Bill’, receiving Royal Ascent, the Council may impose the first premium after a property has been empty for 12 months. As legislation stands, tax payers would require a 12 month notice period before the Council could impose this premium. However, the Government is giving consideration to waiving this notice period by amendment to the Council Tax regulations legislation.