It is imperative that if you are displaying systems of COVID-19 however mild, or have tested positive you must self-isolate for 10 days.

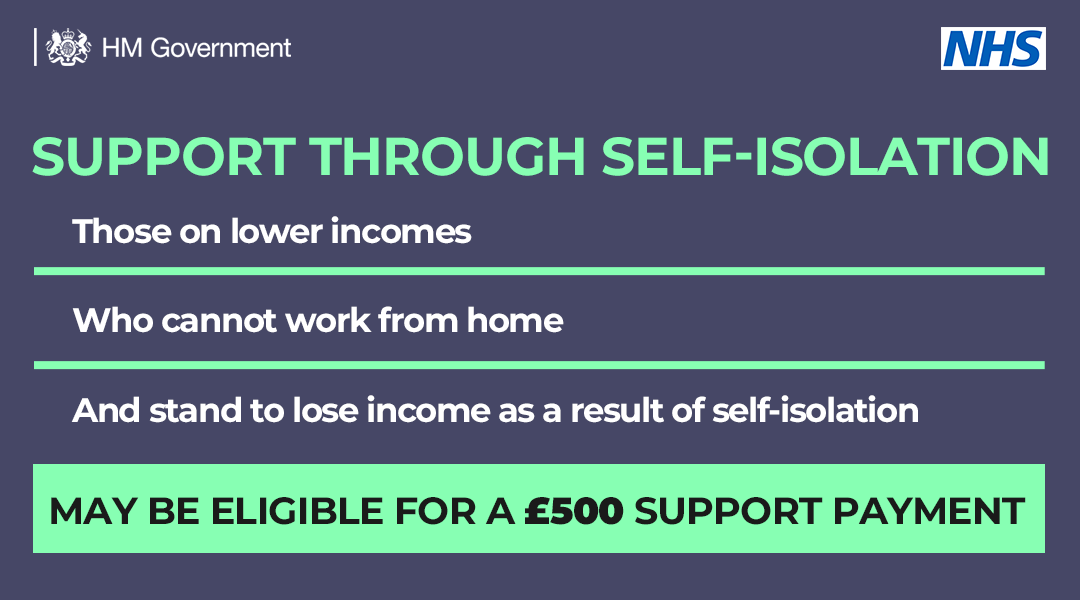

If you are on a low income and are unable to work from home you may be entitled to a Test and Trace Support payment if you have been asked to self-isolate by NHS Test and Trace.

People across England are required by law to self-isolate if they have been asked to do so by NHS Test and Trace, either because they have tested positive for COVID-19, or they have been identified as a named contact of someone who has tested positive.

The scheme which runs until 31 January 2021 and aims to provide important financial support to people who will lose income during their period of self-isolation.

Cllr Steve Darling, Leader of Torbay Council, said; “These payments are designed to ensure people who have tested positive for COVID-19 and their close contacts self-isolate for the required period to stop the onward spread of the virus. They are also designed to encourage individuals who are eligible for this payment to get tested if they have symptoms. This is important to help stop the transmission of COVID-19 and avoid further economic and societal restrictions”.

Cllr Darren Cowell, Deputy Leader of Torbay Council, said: “As a local authority, we want to support our residents as much as possible. If you are on a low income and unable to work from home while you have to self-isolate, you may be entitled to a payment of £500. People in the same household can each make an individual application to receive the payment, if they each meet the eligibility criteria”.

Payment eligibility

Eligibility for a £500 Test and Trace Support Payment is restricted to people who:

- Have been told to stay at home and self-isolate by NHS Test and Trace, either because they have tested positive for coronavirus of have recently been in close contact with someone who has tested positive;

- Are employed or self-employed;

- Are unable to work from home and will lose income as a result; and

- Are currently receiving Universal Credit, Working Tax Credit, income-based Employment and Support Allowance, income-based Jobseeker’s Allowance, Income Support, Housing Benefit and/or Pension Credit

In addition, we will be making £500 discretionary payments to individuals who;

- Have been told to stay at home and self-isolate by NHS Test and Trace, either because they have tested positive for coronavirus or have recently been in close contact with someone who has tested positive;

- Are employed or self-employed; and

- Are unable to work from home and will lose income is a result;

- Are not currently receiving Universal Credit, Working Tax Credit, income-based Employment and Support Allowance, income-based Jobseeker’s Allowance, Income Support, Housing Benefit and/or Pension Credit; and

- Are on low incomes and will face financial hardship as a result of not being able to work while they are self-isolating

For both the Test and Trace Support Payment and discretionary payments, eligible individuals will receive their £500 payment on top of any benefits and Statutory Sick Pay (SSP) that they currently receive.

We are accepting applications for both payments from people who were told to self-isolate on or after 28 September by NHS Test and Trace and who meet the relevant eligibility criteria.

Making an application

Applications need to completed online or by calling 01803 207201 if the individual is digitally excluded. The following supporting evidence must also be provided:

- A notification from NHS Test and Trace asking them to self-isolate;

- Proof of receipt of one of the qualifying benefits;

- A bank statement; and

- Proof of employment, or if self-employed evidence of self-assessment returns, trading income and proof that their business delivers services which cannot be undertaken without social contact

Apply for a test and trace support payment, being sure to read the guidance instructions before you start.

To help reduce the spread of COVID-19 in Torbay we all need to remember; Hands. Face. Space.

Find out more about the measures that apply in our area.

News archive

- February 2026 (1)

- January 2026 (19)

- December 2025 (12)

- November 2025 (23)

- October 2025 (19)

- September 2025 (11)

- August 2025 (8)

- July 2025 (17)

- June 2025 (15)

- May 2025 (19)

- April 2025 (7)

- March 2025 (17)

- February 2025 (6)

- January 2025 (13)

- December 2024 (9)

- November 2024 (27)

- October 2024 (21)

- September 2024 (17)

- August 2024 (7)

- July 2024 (24)

- June 2024 (8)

- May 2024 (25)

- April 2024 (19)

- March 2024 (17)

- February 2024 (16)

- January 2024 (14)

- December 2023 (14)

- November 2023 (30)

- October 2023 (21)

- September 2023 (22)

- August 2023 (18)

- July 2023 (17)

- June 2023 (14)

- May 2023 (11)

- April 2023 (9)

- March 2023 (36)

- February 2023 (18)